Banking that manages your money — not just holds it.

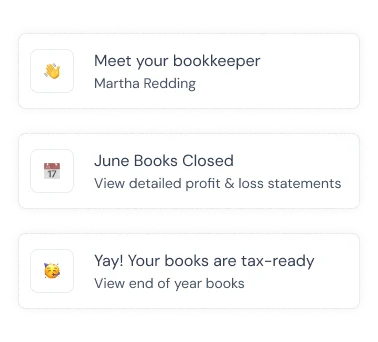

Holdings combines zero-fee banking with AI that categorizes your transactions, generates reports, and keeps your books current — so you don't have to.

The finance hire you never had to make.

Total Balance

$128,459.32

Recent Activity

Trusted by 1,000+ nonprofits and organizations

Everything your business needs in one place

Banking, accounting, bookkeeping, and cards — built to work together.

Give back without thinking about it.

Set up automatic donations from your everyday banking. Perfect for nonprofits and mission-driven businesses.

Learn about Giving Accounts"Great communication and support. The team is always there for us! Transactions are easy and simple, freeing up valuable time spent with other banks trying to get wires/transfer released."

— E. Lamsus, Trustpilot Review

This transition will support our mission by streamlining how we manage donor contributions and program impact — helping us better serve cancer patients in need.

Phil Brown, CEO · Needs Beyond Medicine

How it works

Get started with Holdings — four steps to running your finances with ease.

Open your account

Basic docs. Approved in minutes, not weeks.

Organize your accounts

Unlimited sub-accounts. Every dollar tracked from day one.

Connect your team

Invite your team with role-based permissions and shared cards.

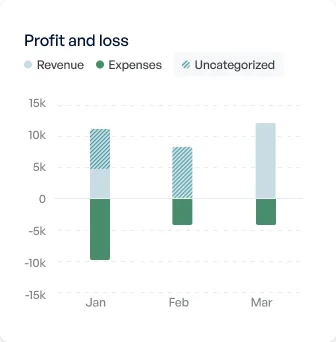

Watch every dollar work harder

Auto-categorized transactions. Board-ready reports on demand.

Business Checking

$84,231.50

Operations

$32,150

Marketing

$18,400

Holdings Visa

**** 4821

Active

Recent Transactions

Google Ads

Marketing

-$2,450.00

Client Payment

Revenue

+$8,500.00

Office Supplies

Operations

-$342.99

Want a walkthrough first?

Frequently asked questions

Who is Holdings designed for?

Holdings is built for small businesses and the people who build them. Our integrated banking, accounting, bookkeeping, and cards platform helps business owners manage their finances in one place — so they can focus on what they do best.

How do Giving Accounts work?

Supporters open a personal banking account linked to your nonprofit. They earn 0.5% APY on their balance, and Holdings matches that 0.5% as a direct contribution to your organization. It’s passive, recurring revenue — no donation asks required.

Is Holdings FDIC insured?

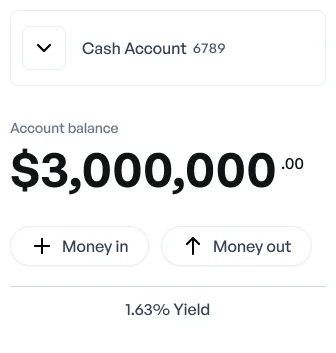

Yes. Holdings accounts are FDIC insured up to $3 million through our banking partner network. We’re also SOC 1 Type II certified, meaning your financial data meets enterprise-grade security standards.

What does it cost?

Banking and fund accounting are completely free — zero monthly fees, zero transaction fees. Bookkeeping services start at $100/month for organizations that want hands-off financial management.

How long does it take to open an account?

Most nonprofit accounts are approved within minutes. You’ll need your EIN and basic organizational documents — no branch visits, no fax machines, no waiting weeks for approval.

Bank-Grade Security

Your money. Protected.

We use the same security measures as the world's largest financial institutions to keep your funds and data safe.

SOC 1 Type II Compliant

Independently audited security controls that meet enterprise standards.

Two-Factor Authentication

Secure your account with SMS, authenticator apps, or hardware keys.

Penetration Testing

Regular third-party security assessments to identify vulnerabilities.

Transaction Monitoring

Real-time fraud detection and suspicious activity alerts.

Automated Backups

Your data is backed up continuously with point-in-time recovery.

End-to-End Encryption

256-bit AES encryption for all data at rest and in transit.

We never share your data. Period. See our privacy policy

Bank-grade security since day one.

Ready to make every dollar work harder?

Open a nonprofit account in minutes — or schedule a demo to see Holdings in action.

No credit card required. Set up in minutes.

FDIC Insured · Zero-fee banking · 1.75% APY

Get Started FreeFDIC Insured · Zero-fee banking · 1.75% APY

Get Started Free