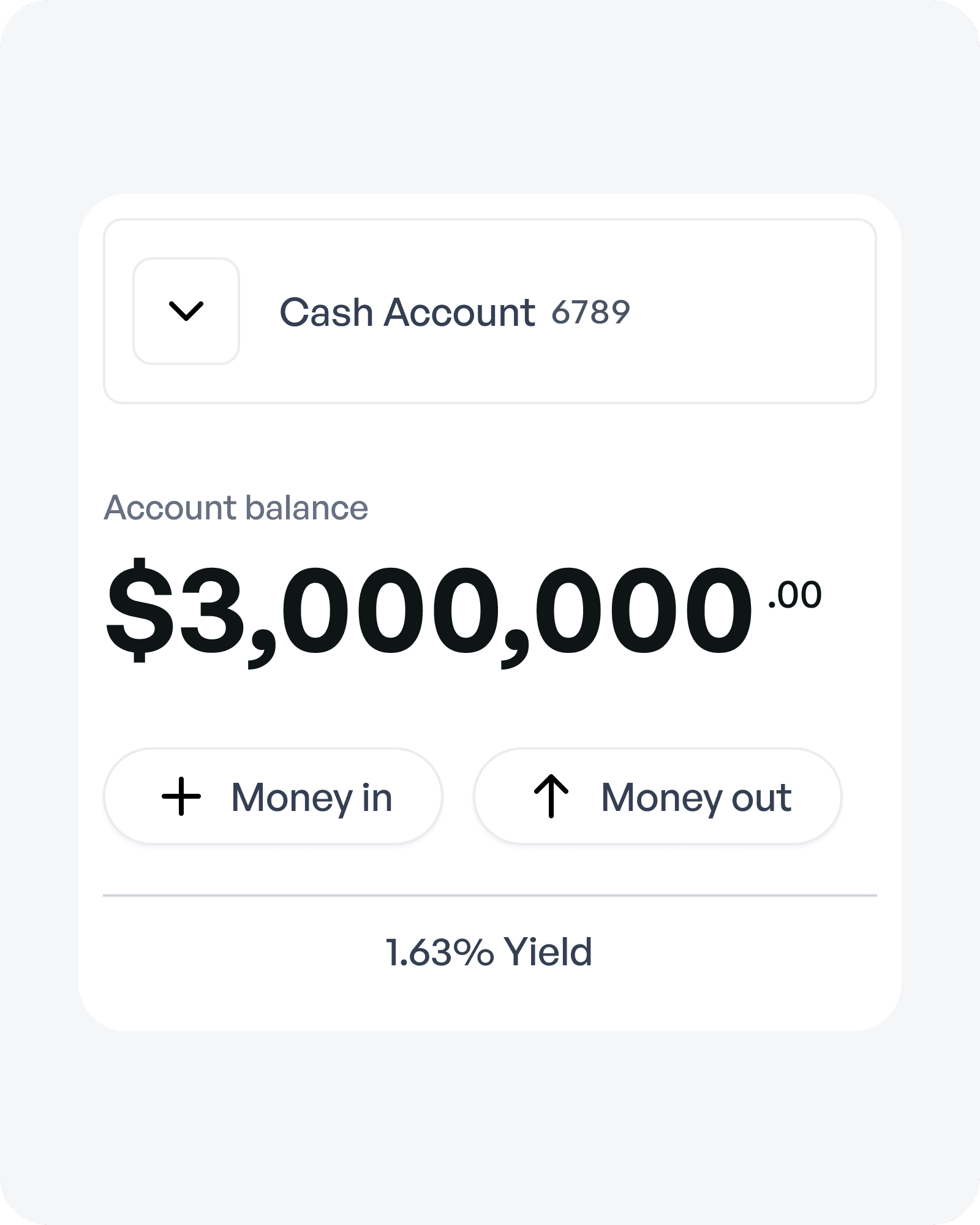

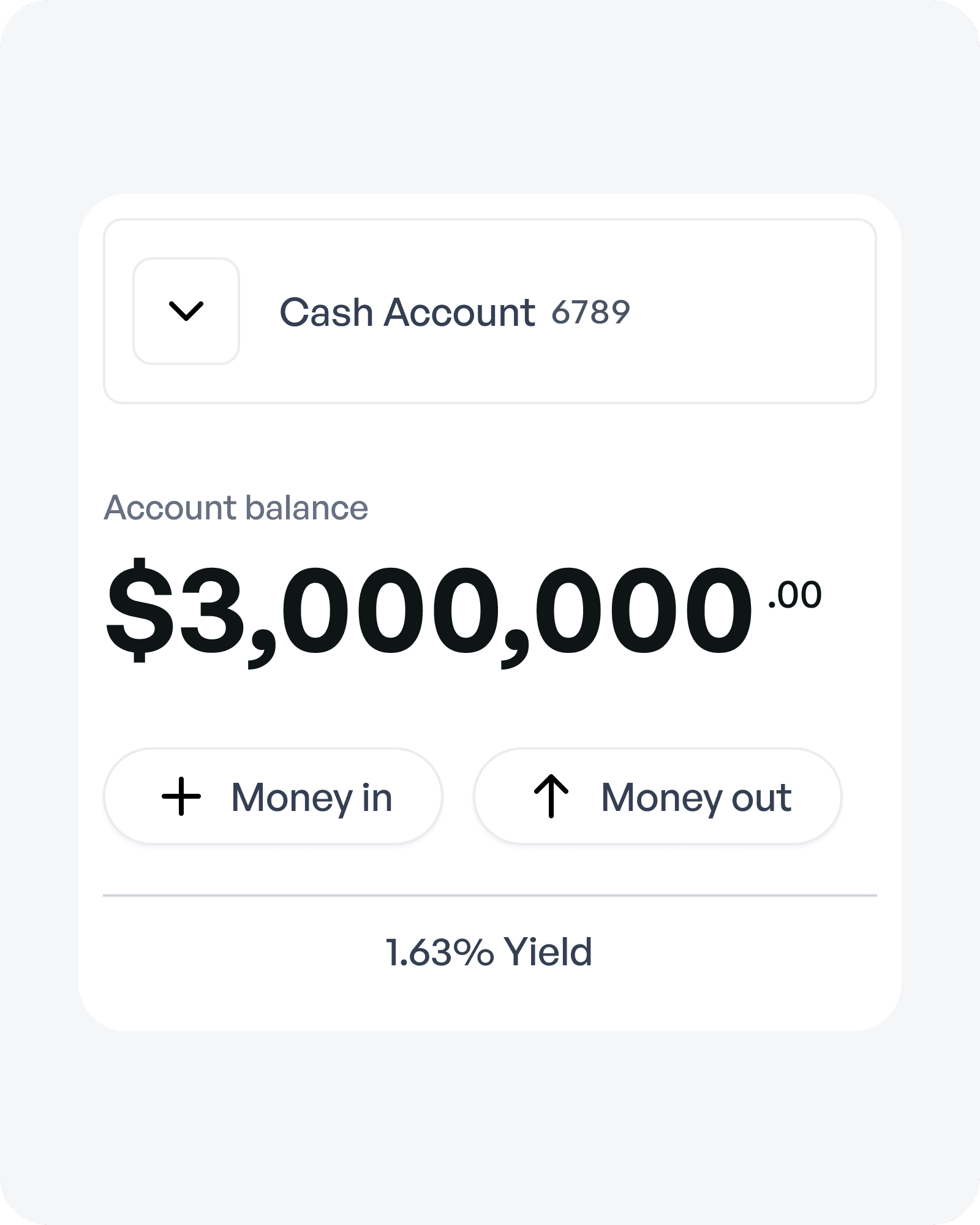

Unlock zero-fee2 banking, a 1.63% APY3 on all balances, and seamless accounting—all in one platform built for real business growth.

Unlock zero-fee2 banking, a 1.63% APY3 on all balances, and seamless accounting—all in one platform built for real business growth.

Unlock zero-fee2 banking, a 1.63% APY3 on all balances, and seamless accounting—all in one platform built for real business growth.

Application Approved

Welcome to Holdings!

Account Funded

Funds have been added to your account!

New Card Added!

New debit card added to your account.

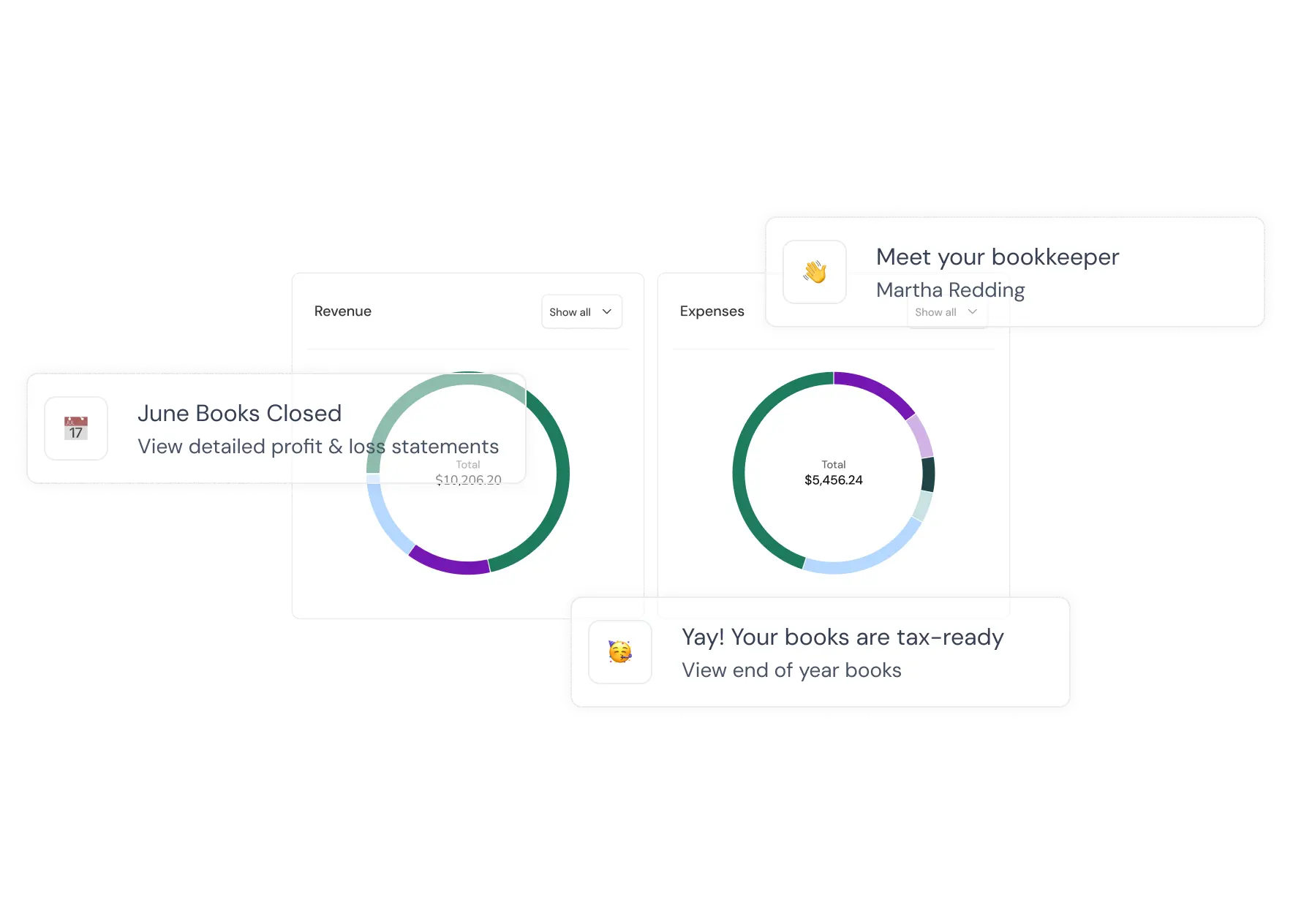

Welcome to Holdings Accounting!

Effortless accounting that is updated as you go.

Message from your bookkeeper

Your books are now closed and up to date—let me know if you have any questions!

Personal Account Created

Personal and business in the same place

Effortless Organization

Instantly create as many accounts as you need—Keep your finances organized by separating funds for taxes, payroll, or specific business initiatives.

Instantly create as many accounts as you need—Keep your finances organized by separating funds for taxes, payroll, or specific business initiatives.

Flat 2% APY on Every Dollar

Earn a straightforward, high-yield 2% Annual Percentage Yield3 on every eligible dollar in your account.

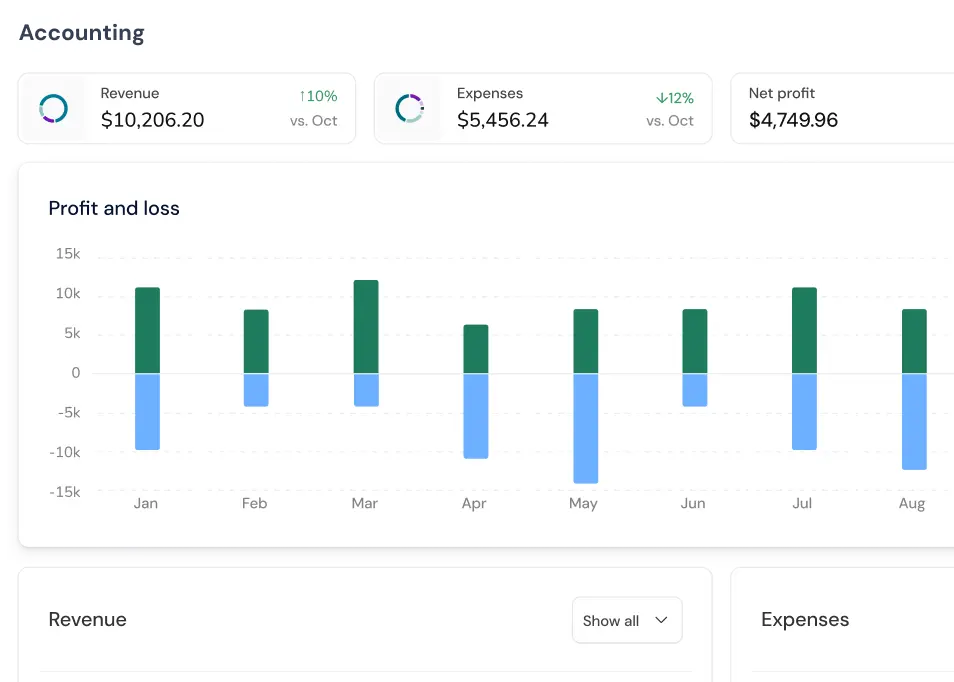

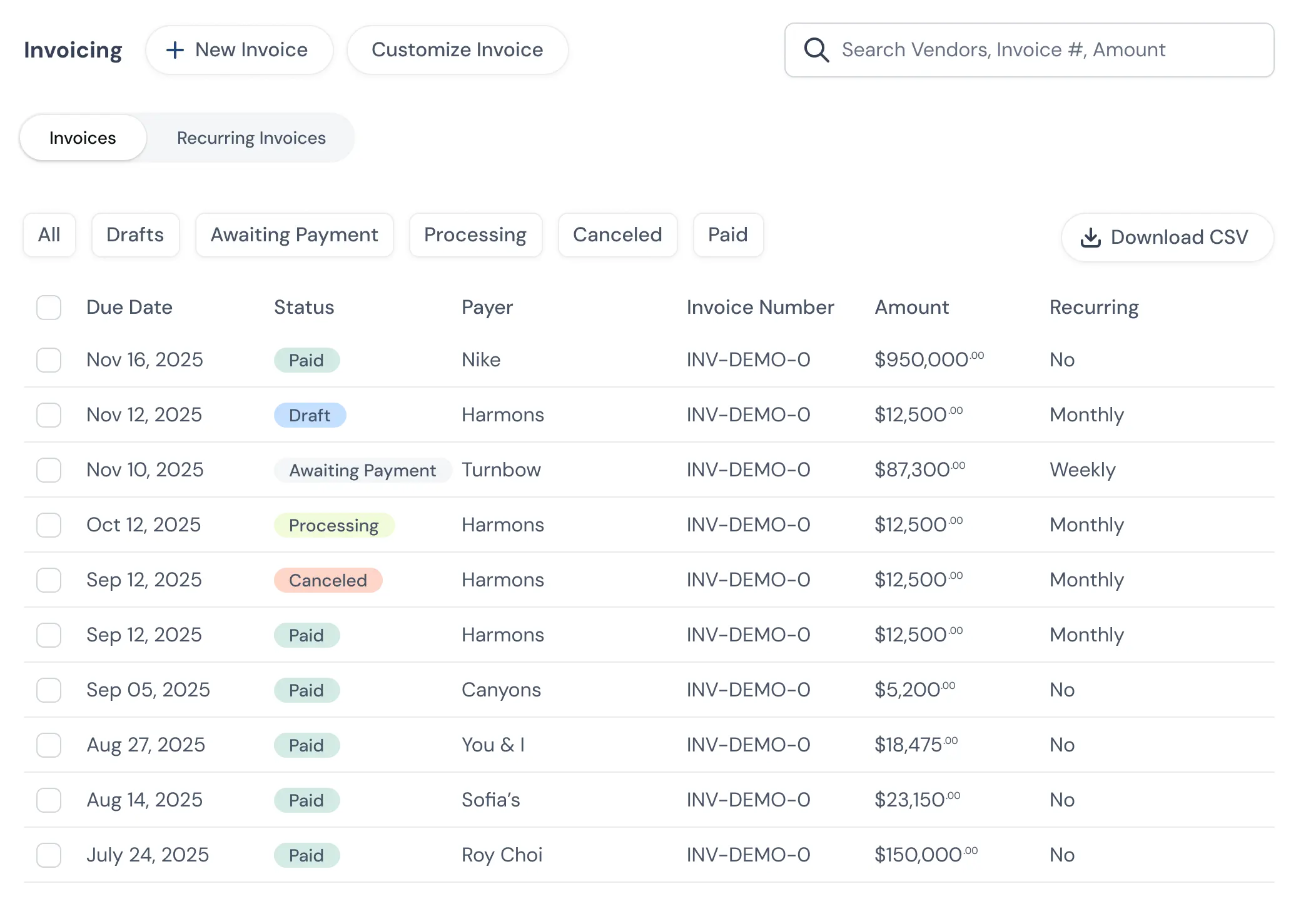

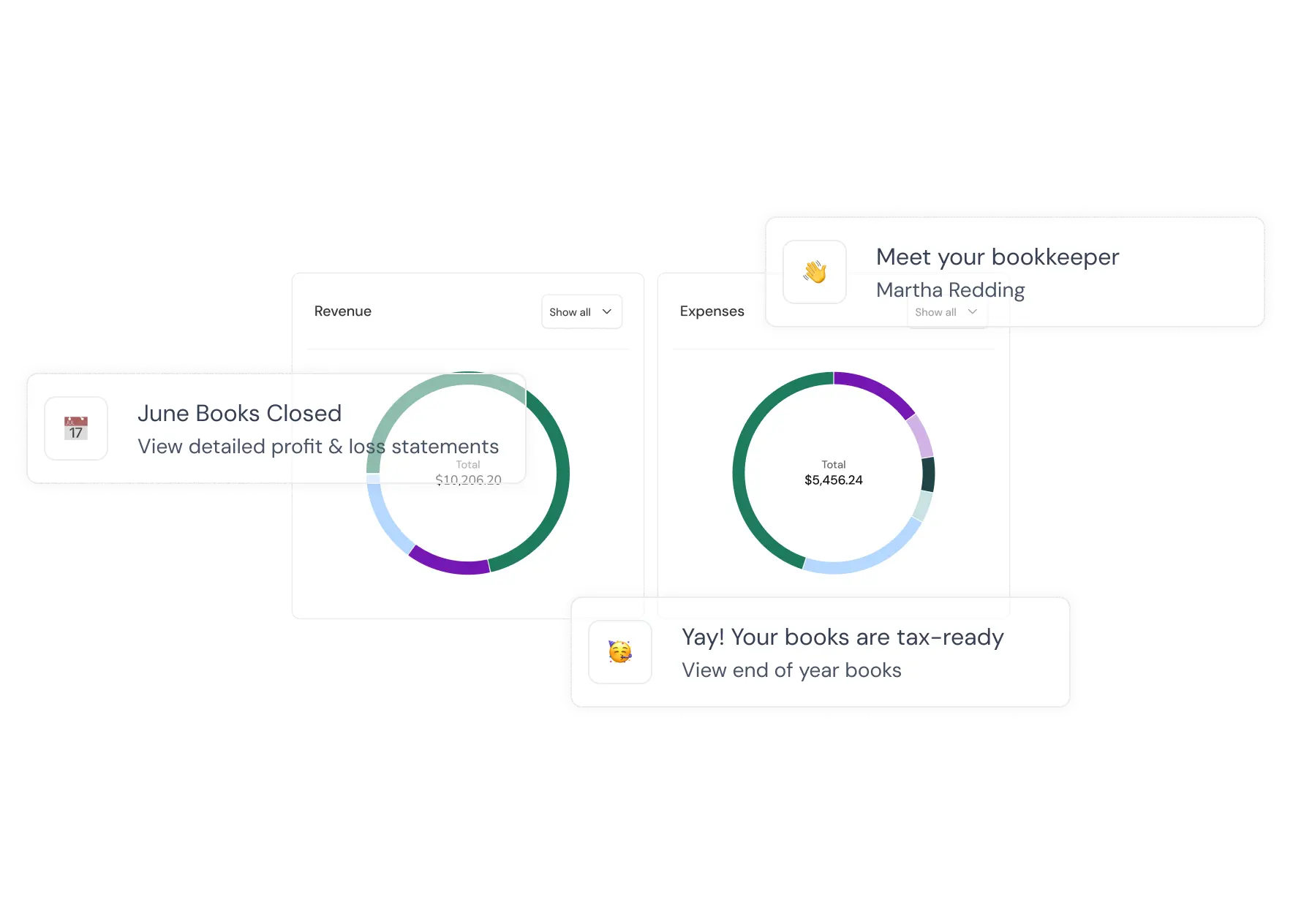

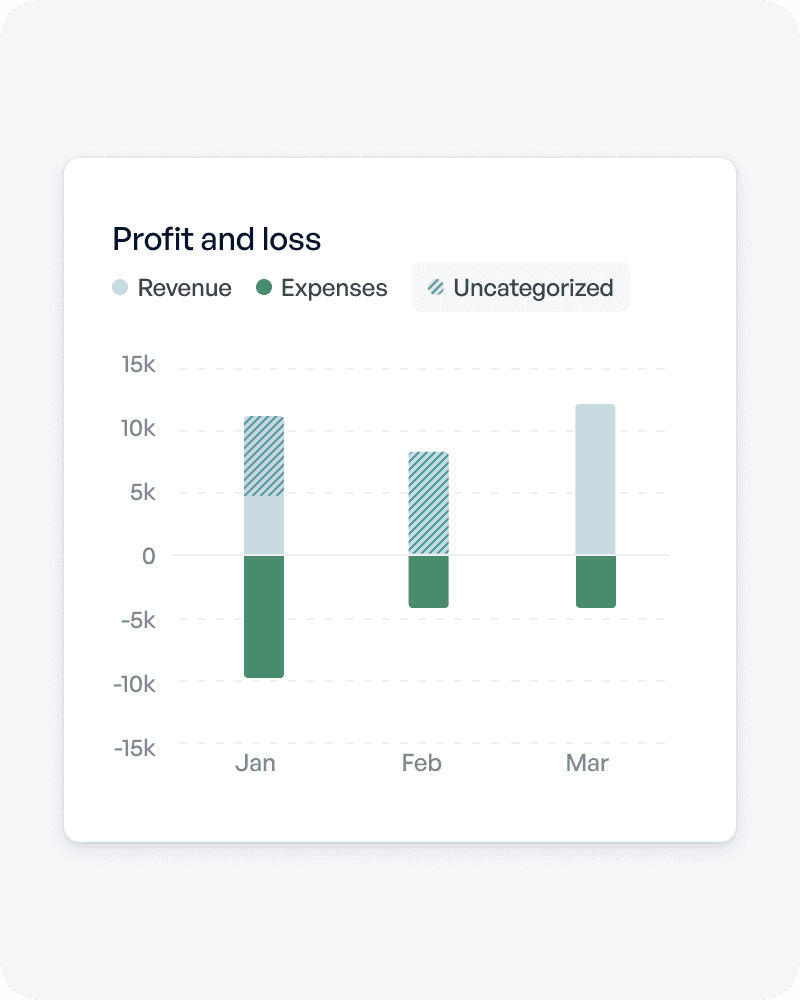

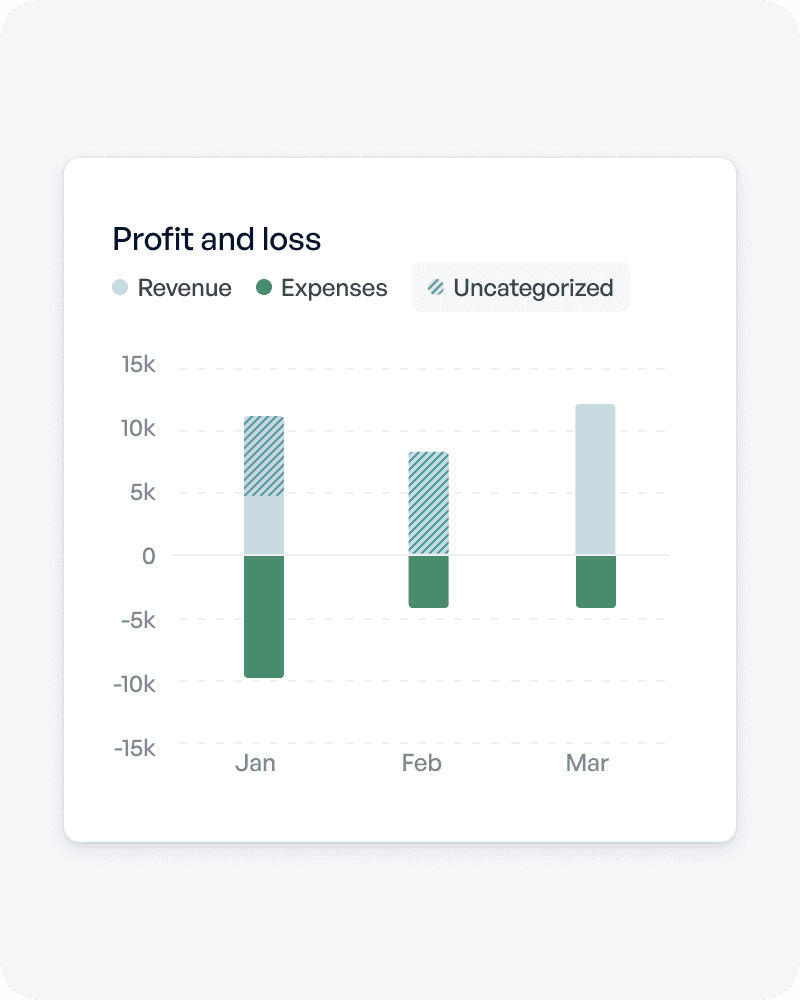

Banking + Accounting + Bookkeeping

Manage banking1, integrated accounting, and full-service bookkeeping from a single, easy-to-use dashboard.

Enjoy 3 Months of Bookkeeping or Accounting

Enjoy 3 Months of Bookkeeping or Accounting

Enjoy 3 Months of Bookkeeping or Accounting

Track bank and credit card expenses

Track bank and credit card expenses

Effortless expense categorization

Effortless expense categorization

Receipt tracking

Receipt tracking

Profitability charts & graphs

Profitability charts & graphs

Full accounting reports

Full accounting reports

Please see terms and conditions for more details.

Business Insights Blog

Business Insights Blog

Stay updated on the latest business insights, tips and tricks to run your business finances

Stay updated on the latest business insights, tips and tricks to run your business finances

Stay updated on the latest business insights, tips and tricks to run your business finances

Sign up for Hustle Handbook

Tips to Help You Do More

Get smart ways to boost cash flow, save time, and keep your team thriving. Our free handbook brings you practical strategies and insights trusted by busy leaders, so work feels organized and progress comes faster.

Sign up for Hustle Handbook

Tips to Help You Do More

Get smart ways to boost cash flow, save time, and keep your team thriving. Our free handbook brings you practical strategies and insights trusted by busy leaders, so work feels organized and progress comes faster.

Sign up for Hustle Handbook

Tips to Help You Do More

Get smart ways to boost cash flow, save time, and keep your team thriving. Our free handbook brings you practical strategies and insights trusted by busy leaders, so work feels organized and progress comes faster.