Finance Ops for Agencies, Studios & Service Firms

We watch the cash, close the books, and send the reports. You just run the business.

We watch the cash, close the books, and send the reports. You just run the business.

We watch the cash, close the books, and send the reports. You just run the business.

Application Approved

Welcome to Holdings!

Account Funded

Funds have been added to your account!

New Card Added!

New debit card added to your account.

Welcome to Holdings Accounting!

Effortless accounting that is updated as you go.

Message from your bookkeeper

Your books are now closed and up to date—let me know if you have any questions!

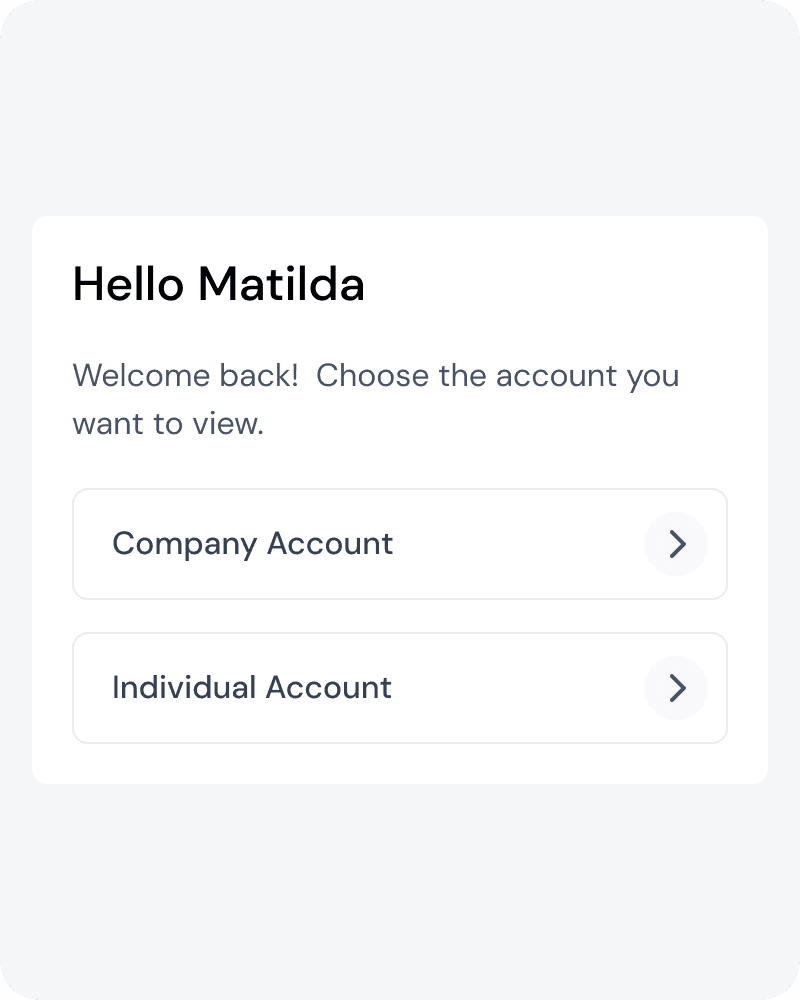

Personal Account Created

Personal and business in the same place

Application Approved

Welcome to Holdings!

Account Funded

Funds have been added to your account!

New Card Added!

New debit card added to your account.

Welcome to Holdings Accounting!

Effortless accounting that is updated as you go.

Message from your bookkeeper

Your books are now closed and up to date—let me know if you have any questions!

Personal Account Created

Personal and business in the same place

Holdings is a financial technology company and is not a bank. Banking services are provided by i3 Bank, Member FDIC. The Holdings Visa Debit Card is issued by i3 Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa cards are accepted.

As Seen On

As Seen On

Agency owners are amazing at delivery. They're drowning in finance.

Agency owners are amazing at delivery. They're drowning in finance.

Agency owners are amazing at delivery. They're drowning in finance.

Stop juggling a bookkeeper, banks, and spreadsheets. Holdings replaces it all with one integrated system.

Stop juggling a bookkeeper, banks, and spreadsheets. Holdings replaces it all with one integrated system.

Stop juggling a bookkeeper, banks, and spreadsheets. Holdings replaces it all with one integrated system.

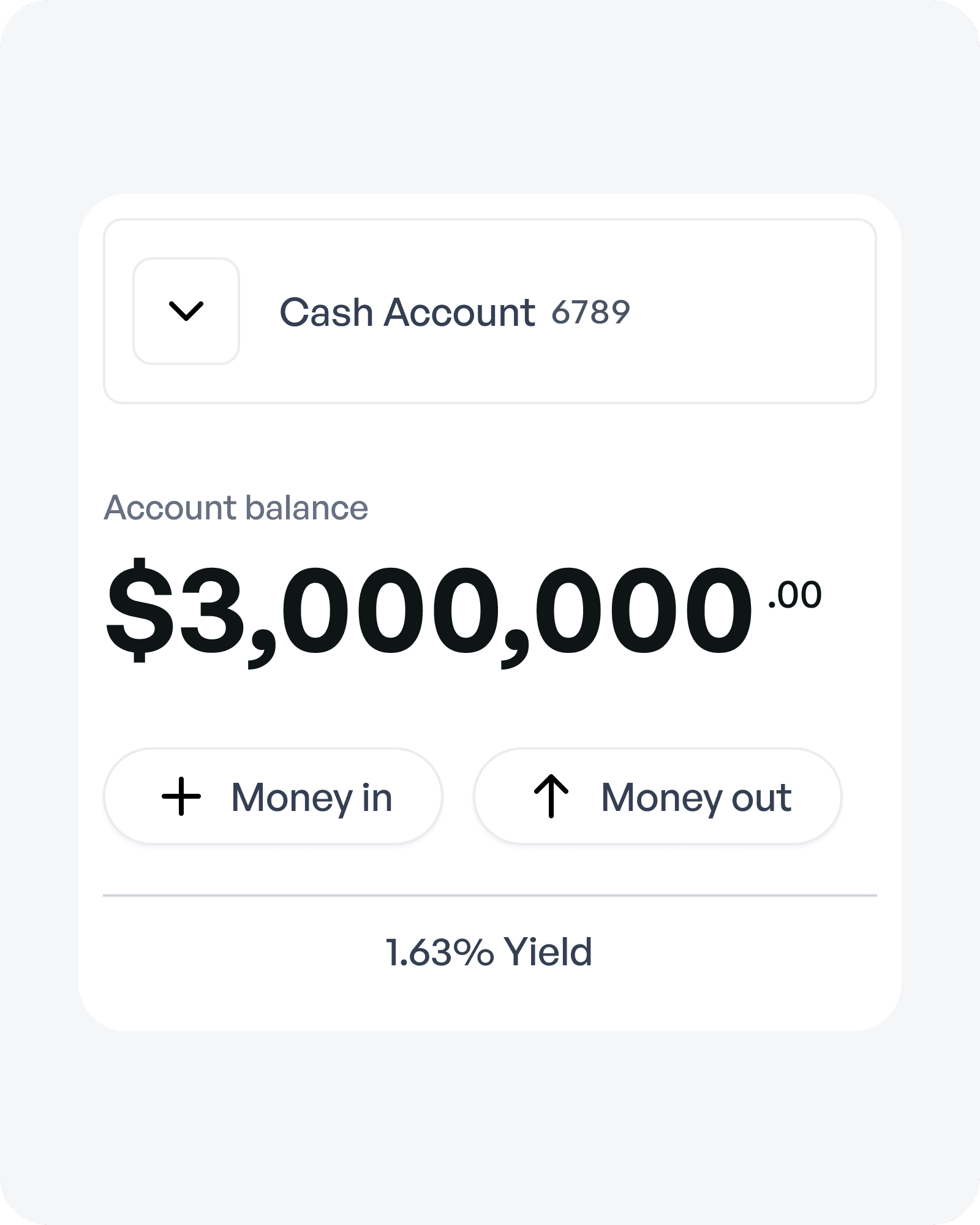

Bank + Cash Flow Dashboard

See your current cash position, upcoming payments, and projected runway for the next 4–8 weeks—all in one place.

Always-current books

Always-current books

Never wonder about your financial position again and have tax-ready numbers. Your CPA will thank you for organized, accurate data.

Your bank, your books, one back office

Your bank, your books, one back office

Your bank, your books, one back office

Connect and clean up

We connect to your current accounts and books, pull the last few months of activity, and clean up your books.

Connect and clean up

We connect to your current accounts and books, pull the last few months of activity, and clean up your books.

Connect and clean up

We connect to your current accounts and books, pull the last few months of activity, and clean up your books.

We do your bookkeeping

Every transaction is categorized and reconciled automatically, with humans focusing on accuracy where it matters.

We do your bookkeeping

Every transaction is categorized and reconciled automatically, with humans focusing on accuracy where it matters.

We do your bookkeeping

Every transaction is categorized and reconciled automatically, with humans focusing on accuracy where it matters.

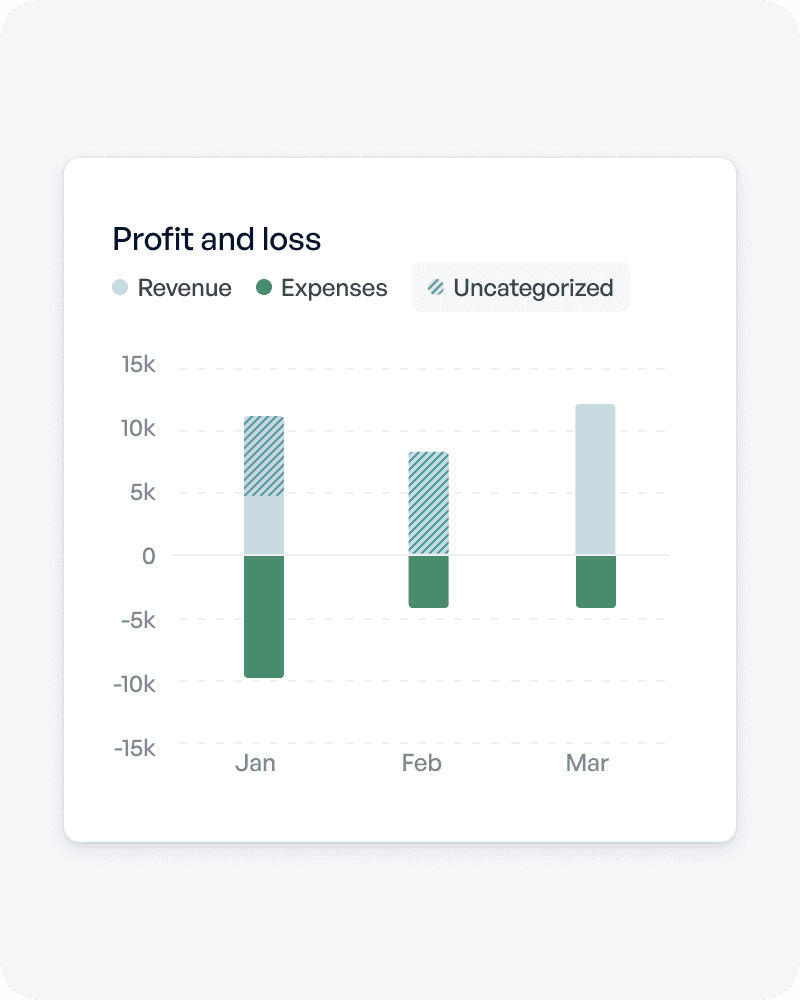

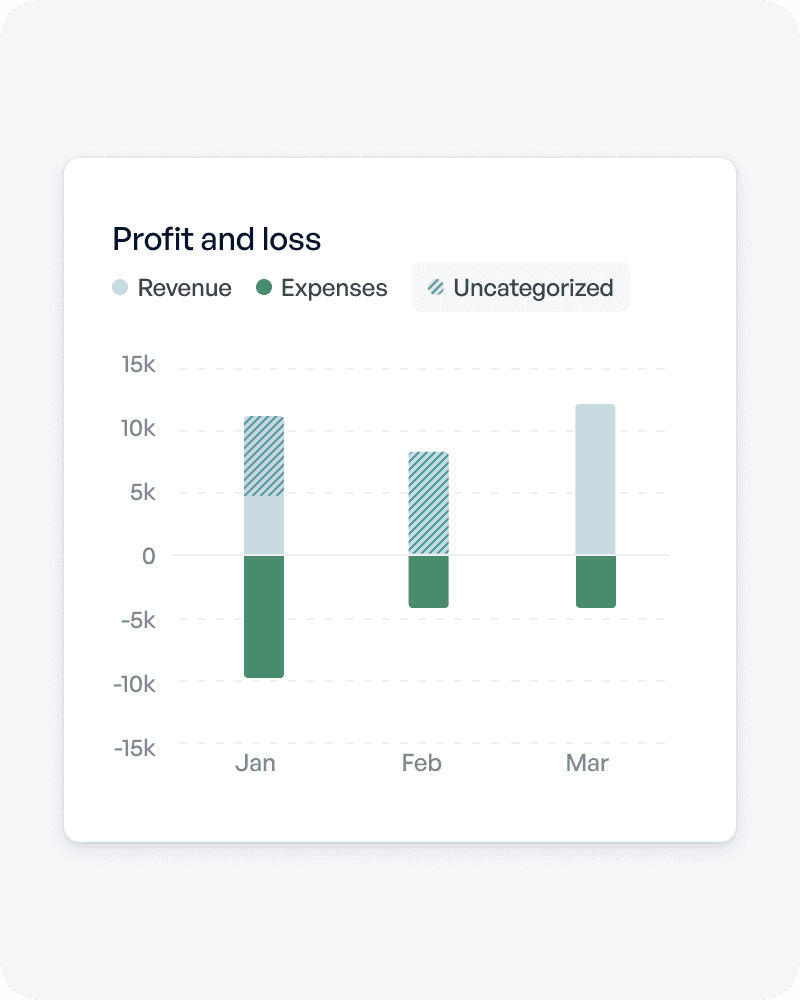

Monthly finance pack

Each month, you get a simple P&L, balance sheet, and cash‑flow view that you and your CPA can actually read—delivered on time every month.

Monthly finance pack

Each month, you get a simple P&L, balance sheet, and cash‑flow view that you and your CPA can actually read—delivered on time every month.

Monthly finance pack

Each month, you get a simple P&L, balance sheet, and cash‑flow view that you and your CPA can actually read—delivered on time every month.

Trusted by Agency Leaders

Trusted by Agency Leaders

Hundreds of creative agencies, studios, and service firms use Holdings.

Business money made simple —

support you can count on.

Hundreds of creative agencies, studios, and service firms use Holdings.

Easy to Use

Debit Cards

Always-Ready Reports

Real Support

Seamless Access

Easy to Use

Debit Cards

Always-Ready Reports

Real Support

Seamless Access

Welcome to Holdings FAQ!

What You Need to Know About Holdings

What You Need to Know About Holdings

What You Need to Know About Holdings

How quickly can I access my funds?

What kinds of payments and deposits are supported?

Are there any fees?

Do I need extra accounting or bookkeeping software?

Can I separate different programs, projects, or business accounts?

How is my money protected?

What support do I get?

How quickly can I access my funds?

What kinds of payments and deposits are supported?

Are there any fees?

Do I need extra accounting or bookkeeping software?

Can I separate different programs, projects, or business accounts?

How is my money protected?

What support do I get?

How quickly can I access my funds?

What kinds of payments and deposits are supported?

Are there any fees?

Do I need extra accounting or bookkeeping software?

Can I separate different programs, projects, or business accounts?

How is my money protected?

What support do I get?

Money Done Right, Progress That Lasts

Money Done Right, Progress That Lasts

Fresh ideas and guides for owners who want their money to do more—so you make smarter moves and keep your business or mission thriving.

Fresh ideas and guides for owners who want their money to do more—so you make smarter moves and keep your business or mission thriving.

Sign up for Hustle Handbook

Tips to Help You Do More

Get smart ways to boost cash flow, save time, and keep your team thriving. Our free handbook brings you practical strategies and insights trusted by busy leaders, so work feels organized and progress comes faster.

Sign up for Hustle Handbook

Tips to Help You Do More

Get smart ways to boost cash flow, save time, and keep your team thriving. Our free handbook brings you practical strategies and insights trusted by busy leaders, so work feels organized and progress comes faster.

Sign up for Hustle Handbook

Tips to Help You Do More

Get smart ways to boost cash flow, save time, and keep your team thriving. Our free handbook brings you practical strategies and insights trusted by busy leaders, so work feels organized and progress comes faster.