Holdings' QuickBooks Integration and Accounting Tools

Managing your business finances shouldn't feel like a juggling act. At Holdings, we've crafted powerful tools to simplify your accounting processes so you can focus on what truly matters—growing your business.

Seamless Integration with QuickBooks Online

One of our standout features is the effortless integration with QuickBooks Online (QBO). Connecting your Holdings account to QBO can automate your accounting and save valuable time. Here's how to get started:

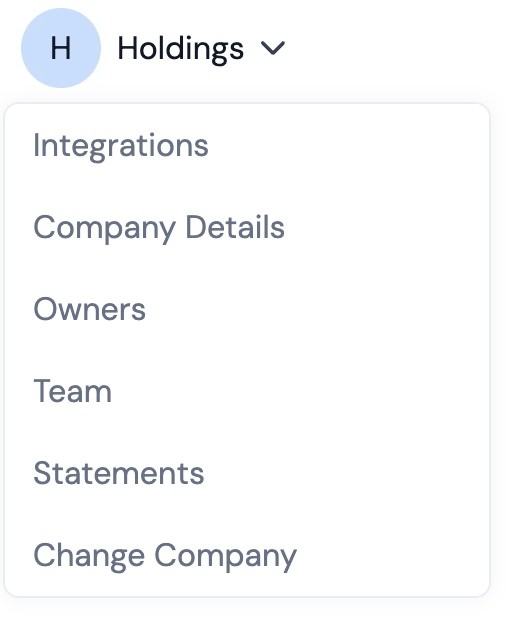

Log in to your Holdings account and navigate to the "Integrations" section.

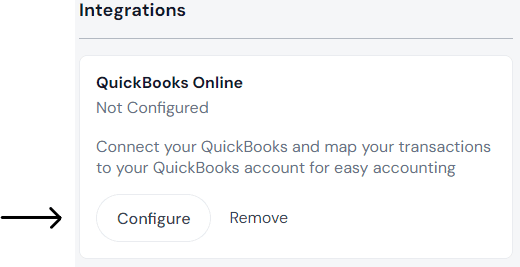

Click "Configure" to connect your QBO account.

Log in to QBO when prompted, and voilà—your accounts are linked!

Categorize Transactions for Clarity

Accurate transaction categorization is critical to clear financial data. Here's how we recommend categorizing:

Yield Payouts: As Interest Income.

Fees: Under Bank Fees or a related subset.

Transfers: Use Undeposited Funds to move between accounts.

Configuring Your QBO Integration

To ensure Holdings auto-categorizes transactions within QBO:

Go to "Integrations" and select "Configure."

Assign your Holdings Cash Account to an existing or new bank account in QBO.

Set a "Starting Date" for importing transactions.

Assign categories for transactions within Holdings.

Connecting to Other Accounting Platforms

Currently, Holdings integrates with QBO, but we're expanding! Soon, you'll be able to connect with platforms like Netsuite, Sage Intacct, and Xero. Meanwhile, our OFX export feature allows you to upload transactions into any accounting platform.

Exporting Transaction Data

To export your transaction data:

Navigate to the "Activity" tab.

Select "Export" and choose CSV or OFX format.

Your file will be saved in your downloads folder.

At Holdings, we're committed to providing the tools you need for success. By automating your accounting processes and leveraging our integrations, you can streamline operations and easily achieve your financial goals.

Ready to take control of your finances? Let's chat about how Holdings can power up your business strategy!

About us

Account

Partnerships

Legal Disclosures

Disclaimers and footnotes

© 2023-2024 Holdings Financial Technologies Inc. All rights reserved. Holdings is a financial technology company, not a bank. Banking services provided by Evolve Bank & Trust, Member FDIC

Funds deposited in your Holdings account are held by Evolve Bank & Trust, Member FDIC. The standard deposit amount is $250,000 per depositor, per insured bank, for each account ownership category. Through Evolve's Sweep Program, funds may be eligible for up to $5M in FDIC insurance. Find additional information about the Sweep Program here